Owning a restaurant is undoubtedly a viable business idea. After all, food is an essential commodity. Moreover, revelers are always more than ready to eat out and sample brilliant delicacies. However, starting a restaurant is expensive, and raising the much-needed capital often daunts many would-be restaurant owners.

So, how does an entrepreneur obtain adequate funds to start their first restaurant?

Here are some inspirational ideas.

Find Investors

If you have honed sufficient skills to run a restaurant, but funding is the only limitation you have, you should consider finding an investor. When you're considering a possible investor make sure you conduct adequate background checks. It will keep you from entering into unpleasant contracts, or even losing control of your restaurant.

It is equally critical that you have a solid business plan which demonstrates the profitability of the company, as well as how and when you intend to repay the investor(s). Lastly, you may also want to have an exit plan on how to buyout or part ways with the investor.

Family & Friends

If the prospect of approaching an investor doesn’t sound appealing, a more friendly option would be to approach friends and family members. The good thing with family and friends is that they already know you. Which means they are likely to trust you much faster than an outside investor.

Mixing friends and business can get messy. You'll have to figure out how to manage your friendship without interference from your business venture. It's best you have everything documented if you decide to go this route. You should have contracts that clearly define the parameters, roles, and obligations of all parties.

Consider SBA Loans

Another convenient way of securing funding for your restaurant is to work the loan application through the US SBA (Small Business Association). The SBA not only offers loans to small business start-ups, but they also guarantee the loans against default. As a result, financiers like banks and credit unions are less apprehensive of taking on risks associated with a new restaurant.

When considering an SBA loan, take the time to shop for the one whose terms are favorable. Fortunately, there are many competitive SBA loan programs from which to choose. Nonetheless be prepared to deposit cash up front, as nearly all SBAs have that requirement.

Bank Loans

Banks can be a great source for acquiring business loans. But due to the high failure rate of restaurants, it's difficult to obtain financing from most banks. However, that should not dampen your spirits. If you have a sound business plan and sufficient assets to offset the credit, you should not hesitate to discuss with your banker. He or she will advise you of the different funding options that you can pursue, including the SBA loans.

Credit Union Loans

Just like SBA loans, Credit Unions are an excellent source of obtaining financing for your restaurant. What makes the Credit Unions attractive is that they charge interest on the loan balance. Which means, if you pay off the loan quickly, you will end up paying less interest.

If you have done solid market research, and crafted a reliable business plan guaranteed to succeed in the first few days, you should consider credit union loans.

Crowd Funding

Thanks to the internet and social media platforms, a restaurateur can secure financing for through crowd funding. You can approach the general public and request for small contributions. The small donations from different people eventually add up to a significant amount.

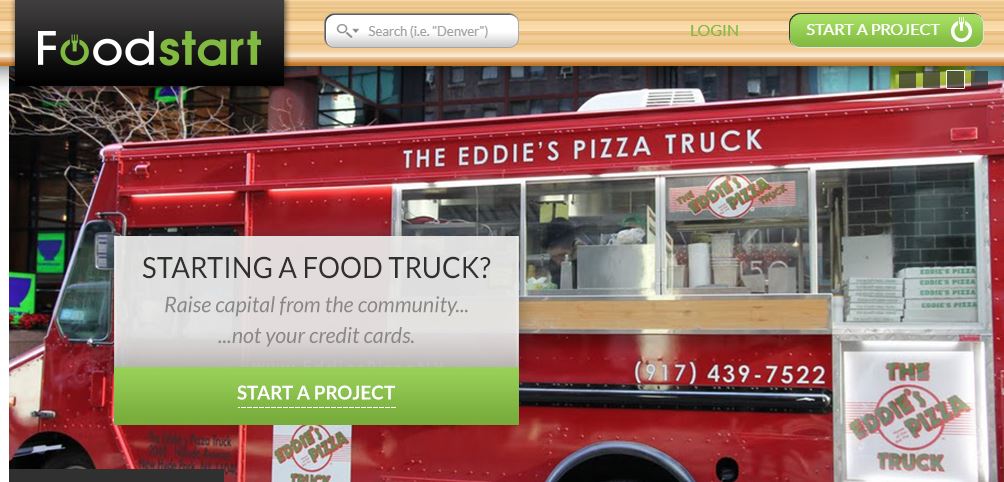

A modern community-funding platform tailored for restaurants and food trucks is Foodstart. Through the program, your family members, friends, customers, and non-customers can back your small business by pledging small amounts. In return, you decide what perks to give to your backers. It can be free food, discounts, or even menu items named after them.

Home Equity Loan

Did you know that your home can help you finance your new restaurant? Well, it can.

Through a home-equity loan, you can use the home as collateral. However, only consider this financing option if you are confident of your restaurant’s success. Otherwise, you might end up losing both the home and the restaurant.

Peer-to-Peer Lending

Another restaurant funding source is peer-to-peer lending. It is closely related to crowd funding, the primary distinction being that in peer-to-peer lending you pay the lenders a premium interest rate. The good thing about this kind of financing is that it enables you to accumulate start-up funds from complete strangers.

Cash Advance

Due to the varied financial needs that exist in the market, many innovative money lenders have emerged. For instance, there are those like Rapid Advance who offer cash advance loans to fund small businesses. Under such an arrangement, a restaurateur can acquire cash up front. However, the loans attract premium interests at times going over 20%, which might leave a sizable dent in the restaurant's bottom line.

Once you find a source of financing the fun begins. You'll now have to come up with your menu, purchase equipment, and hire staff. It's important you properly maintain your restaurant to avoid health infractions.

If you're starting up a new restaurant in North Carolina don't hesitate to reach out to Greasecycle for help with your grease trap cleaning and used cooking oil recycling! We hope to hear from you soon and good luck in your new venture!